Thursday, December 10, 2009

Food prices on fire, I see some actions coming from the RBI

Friday, October 9, 2009

Hey Readers 9 Oct '09

Wednesday, July 29, 2009

Analysis on the RBI’s monetary policy for 2009-10

The RBI looked more sanguine about the domestic growth outlook yesterday than the last policy review in Apr’09. According the policy document, the business outlook in the country has turned positive signaling a revival of industrial activity. However, the RBI expects the export demand to continue to remain weak in coming months and the services sector may experience the drag of sluggish external demand and the lagged adverse impact of the weak industrial growth. Also, the below normal monsoon this year is likely to pull down the agriculture production for the Kharif season crop. Weighing all these factors, the RBI’s the growth projection for GDP for 2009-10 is placed at ‘6% with an upward bias’. I fee the RBI has been a tad conservative about the GDP forecast. As the recent macro-data points to a better economic environment, the economy is likely to grow at 6.5% in 2009-10.

Inflation outlook:

On inflation front, RBI expects the annual inflation to go up to 5% by the end of March 2010. It says that the WPI-based inflation, which has slipped below zero, has only statistical significance and doesn’t reflect a contraction in demand and may not persist beyond a few more months. However, it expressed concern about the elevated food inflation and an uncertain monsoon outlook could further accentuate the problem.

Regarding the money supply growth, the RBI projects the M3 money supply to grow at 18% during 2009-10. Furthermore, the bank deposit and the bank credit are projected to be growing at 19% and 20% respectively in 2009-10.

But I see the RBI will be having a bigger responsibility this time. As the fiscal deficit has been estimated at 6.8% of the GDP in 2009-10, the government plans to withdraw Rs 4.5 trn from the market in the current financial year. This has hardened the interest rate in the bond market. At the same time the RBI will have to ensure that there is enough liquidity left in the system so that the private sector also has easy access to the funds. But if the government goes little aggressive on the disinvestment plans, the situation could improve significantly with foreign money flowing into the economy.

Outlook for Rupee:

The RBI’s decision of keeping the policy rates unchanged doesn’t seem to have much impact on the rupee. However, a revival in FII inflows and an improved domestic growth outlook are likely to provide a support to the rupee in the coming months. Risk aversion is also expected to subside on possible global economic recovery towards the end of 2009. Therefore, I expect the rupee to inch towards 46.50-47 levels by end of Mar 2010. In the immediate term, however, rupee could continue taking cues from the direction of domestic equity markets and from the dollar’s movement against other major currencies.

To sum up the whole thing, I would like to add that the nine-month long easing cycle of the interest rate seems to have come to an end and the RBI’s next move will be to increase the key rates which might happen as soon as beginning of 2010.

Friday, July 17, 2009

Slowdown in credit off-take in India

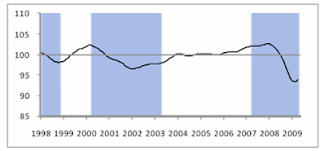

Banks' credit growth rate in India

Source: Nomura, CEIC

Banks have become very reluctant to lend money post Lehman Brothers collapse. They rather prefer putting money with the RBI. There has been excess liquidity in the system for last seven months now, which can be seen by repo liquidity data (see the graph below).

Thursday, July 9, 2009

India Budget 2009-10 spoils the party

Highlights of the budget

(Fiscal year: April 1 – March 31)

§ Real GDP growth assumed at 6.5% in fiscal year 2009-10 – Quite realistic

§ Fiscal deficit projected at 6.8 % of GDP – No roadmap for fiscal consolidation

§ Total expenditure increased by 36 % to Rs 10,208.38 bn over 2008-09 – Govt will have to borrow from markets, leading to upward pressure on interest rates

§ Allocation for the National Highway Development Programme (NHDP) increased 23% in 2009-10. Also, allocation for Bharat Nirman increased 45% in 2009-10 - Infrastructure gets a focus

§ Allocation under National Rural Employment Guarantee Scheme (NREGS) increased by 144 % to Rs 391 bn in 2009-10 – NREGS has been quite successful in the past and will provide further support to the poor

§ Unique Identification Authority of India (UIDAI) to set up online data base for Indian residents and provision of Rs 1.2 bn made for this in the budget – a welcome step

§ No change in corporate tax rate – No relief to corporate India

§ Fringe benefit tax (FBT) to be abolished – Will provide immense relief to millions of people

§ Commodity transaction tax (CTT) to be removed

§ Minimum alternate tax (MAT) to be increased from 10% to 15% of book profits

§ Raised the exemption limit of personal income tax by Rs 10,000 for all categories of individual taxpayers; by Rs 15,000 for senior citizens. Also, surcharge of 10% eliminated on personal income tax – people will have more money to spend

But don’t get too disheartened. Budget is not the only platform to declare all the reformatory actions. The government might declare some more actions whenever it gets ready for them. Think positive!!

Wednesday, July 1, 2009

A silver lining in the cloud!

The Rupee is likely to appreciate in the coming months (see my previous post on rupee), which in turn will make exports less competitive in the international markets. Therefore, the road from here is not going to be smooth for the exporters. However, the government may unveil relief measures in the coming budget on July 6 to help exporters survive. There are expectations that the government may announce a foreign trade policy in Aug’09 to provide further support to the exporters.

Well, this is not all too bad. There is a silver lining here. Indian imports are also falling continuously for past six months at the same time. Imports fell 39.2% (y/y) in May’09 to $16.2 bn, following 36.6% drop in Apr’09. As a result, India’s trade deficit has halved to $5.2 bn in May’09, as compared to $11.2 bn a year ago. A shrinking trade deficit comes as good news for the economy. Don't you think so?

Tuesday, June 30, 2009

Outlook for INR/USD

What went wrong?

Rupee dependence on FII flows

The way forward

A better growth prospect will lead to higher capital inflows in the coming months. This builds up a case for a stronger rupee in the medium-term. Therefore, the rupee is expected to be around 46-levels against the dollar by Mar 2010. However, in the immediate term, the rupee could trade in a volatile range, tracking the developments in the equity markets and also the performance of the dollar vis-à-vis other currencies.

Thursday, June 25, 2009

World Bank: India to grow faster than China in 2010

I was glad to see the World Bank’s latest revisions in its global GDP forecasts on June 22, 2009. Now you must be thinking that I have lost it completely because in that update the World Bank actually revised the global GDP forecasts downward for both 2009 & 10. So why would someone be happy about it? Well, I understand your point. But if you have read my older post on ‘Who will be the next global economic growth leader?’ posted on June 17, 2009, I had written that

Five days later the World Bank comes to support my statement by projecting

Let’s talk about the world economy now. Despite the recent signs of improvement in some parts of the world, the prospects for the global economy remain quite uncertain. According to the World Bank’s revised forecasts, the world GDP will contract by 2.9% in 2009 as compared to 1.7% it had forecast just two months and a half ago. To my mind, the global economy will take some time - say four more quarters - to come out of the trauma of recession.

The policy makers will have to be extra careful about all macro indicators and will have to respond to them accordingly. Structural imbalances which have been created over the period need to be tackled now. The

Monday, June 22, 2009

Signs of global economic recovery or just a mirage?

At a time when people around the world were riding high on early signs of economic recovery, the World Bank (WB) brings them back to the ground reality. According to the WB, which has revised its forecasts on global economic growth to -2.9% in 2009, down from -1.7% projected in Mar’09, the recovery is expected to be very gradual. Have a look at the WB's revised GDP forecasts for 2009 and 2010.

One interesting thing you must have noticed about Indian and Chinese economies. Growth forecasts for both the nations have been revised upward. Now, does it say that the decoupling hypothesis was not a complete absurd and it’s just a beginning? May be a couple of decades later this blissful thought becomes a reality.

Well, for me it’s too early to comment on that. Personally, I don’t believe in ‘decoupling’. If you have views on that please share.

Friday, June 19, 2009

Deflation in India ...Really?

Now, what does this mean? Should we call it deflation or disinflation or something else? To my mind these numbers have only statistical significance. I don’t think

Another important thing to notice is that Inflation in

So if we go by CPI-based inflation rate like most other countries do, inflation in

Secondly, if we calculate WBI-based inflation on a monthly basis, it becomes crystal clear that inflation has been picking up for last three months. Going forward, I expect inflation to pick up sharply around Sep-Oct’09 once the base effect dies its own death.

I don’t think RBI need to cut its key interest rate going forward as it has already brought it down by 425 basis points since October’08. Let me know whether you agree with me or not and if not why so?

Wednesday, June 17, 2009

Who will be the next global economic growth leader?

“I remember myself being the topper of the class for years in my school days? All thanks to my superb tuition teacher. But one day the teacher got married and left the city. And the guy who used to come number two or three stood first in the class that year. Actually, the guy used to study on his own and was not depending on any tuition unlike me.”

I see the same thing happening to

Actually, the global demand has dried up completely on account of global recession.

But that creates a problem for China. Exports contribute more that 35% to

Rest I leave to you to guess who will be the next topper in the world. Yes…You guessed it right.

Saturday, June 13, 2009

Green shoots of recovery in Indian economy

Furthering to my previous post on Indian economy, following are the indicators which indicate that the Indian economy has already bottomed out. Let’s have a look.

There are two interesting things to be noted here. One, India's PMI came out be actually higher than that of China’s 53.1 in May09. And the second one is that domestic demand has been the key driving factor behind it. Exports have been on the falling spree since last eight months as the global demand has dried up completely. So hats off to India’s domestic demand which has helped Indian economy weather through these trying times.

OECD leading indicators: The OECD Composite Leading Indicators (CLIs) for India increased by 0.4 point to 93.9 in Apr09, against 93.5 in the previous month. Buy the way this was the first time in last two years when the OECD leading indicators posted an increase for India, indicating that Indian economy has hit the bottom of the economic cycle.

Industrial production turns positive: This has been the latest flavour of the month. Beating all market expectation, India’s industrial production slipped into positive territory in Apr’09. India’s IIP grew 1.4% (y/y) in Apr’09. Industrial production growth for Mar09 has also been revised upwardly to - 0.8% from -2.3% estimated earlier. Core sector also grew 4.3% in the same month. The problem regarding the industrial production being red for quite some time now seems to be subsiding.

All these indicators suggest a possible recovery going forward. However, the government still has to do a lot many things to put the Indian economy back on the high growth trajectory. Let’s wait for the budget, which will be presented in the first week of July’09. The government has to address many issues regarding the growth. Infrastructure should get a proper attention too. At the same time the government will have to maintain a fiscal balance as well. Let’s hope the government will be able to manage it well.

Tuesday, June 2, 2009

Indian Economy: Where does it go from here?

Hmmm, after all that gloomy tour of the world economy, let’s come back to India. Well, I feel proud to say that it seems that the worst is over for the Indian economy. And there are umpteen reasons why it seems so. The first reason is that India is not an exports driven economy. Exports contribute merely 13.5% to India's overall GDP whereas Chinese exports contribute more than 35% to its GDP.